Skip to main content

The Cash Store website is currently down for maintenance. We apologize for any inconvenience. Please check back after later

Cash Store Blog

What to Know About Crypto-Backed Loans

May 16, 2025

by

Greg T.

Cryptocurrency has come a long way since Bitcoin launched in 2009. What started as a digital alternative to cash has grown into a global asset with real value. One newer option gaining attention is the crypto-backed loan. These loans let you borrow cash while using your cryptocurrency as collateral—without having to sell it. With more people investing in crypto, this lending option has become popular for those who want liquidity without cashing out.

In this blog, we’ll explain how crypto-backed loans work, the risks involved, and what to consider before applying.

How Crypto-Backed Loans Work

If you’ve built up a stash of crypto, you might be wondering if there’s a way to use it without selling it off. That’s where crypto-backed loans come in. These loans let you tap into your crypto’s value while keeping ownership of your digital assets.

A crypto-backed loan is a type of collateralized loan. You deposit your cryptocurrency—like Bitcoin or Ethereum—into a lending platform, and in return, you receive a loan in cash or a stablecoin. Your crypto acts as the collateral, just like a house or car might for a traditional loan.

Popular platforms offering these loans include Nexo and YouHodler. Some crypto exchanges, like Binance and Coinbase, have also started offering lending services.

The amount you can borrow depends on the loan-to-value (LTV) ratio. For example, if the LTV is 50%, and you deposit $10,000 worth of Bitcoin, you might be able to borrow up to $5,000. LTV ratios usually range between 30% and 70%, depending on the platform and the coin you’re using.

The catch? If your crypto drops in value and your LTV gets too high, the lender may require you to add more collateral—or they might sell off your crypto to cover the difference. So while crypto-backed loans offer flexibility, they also carry some risk if the market swings.

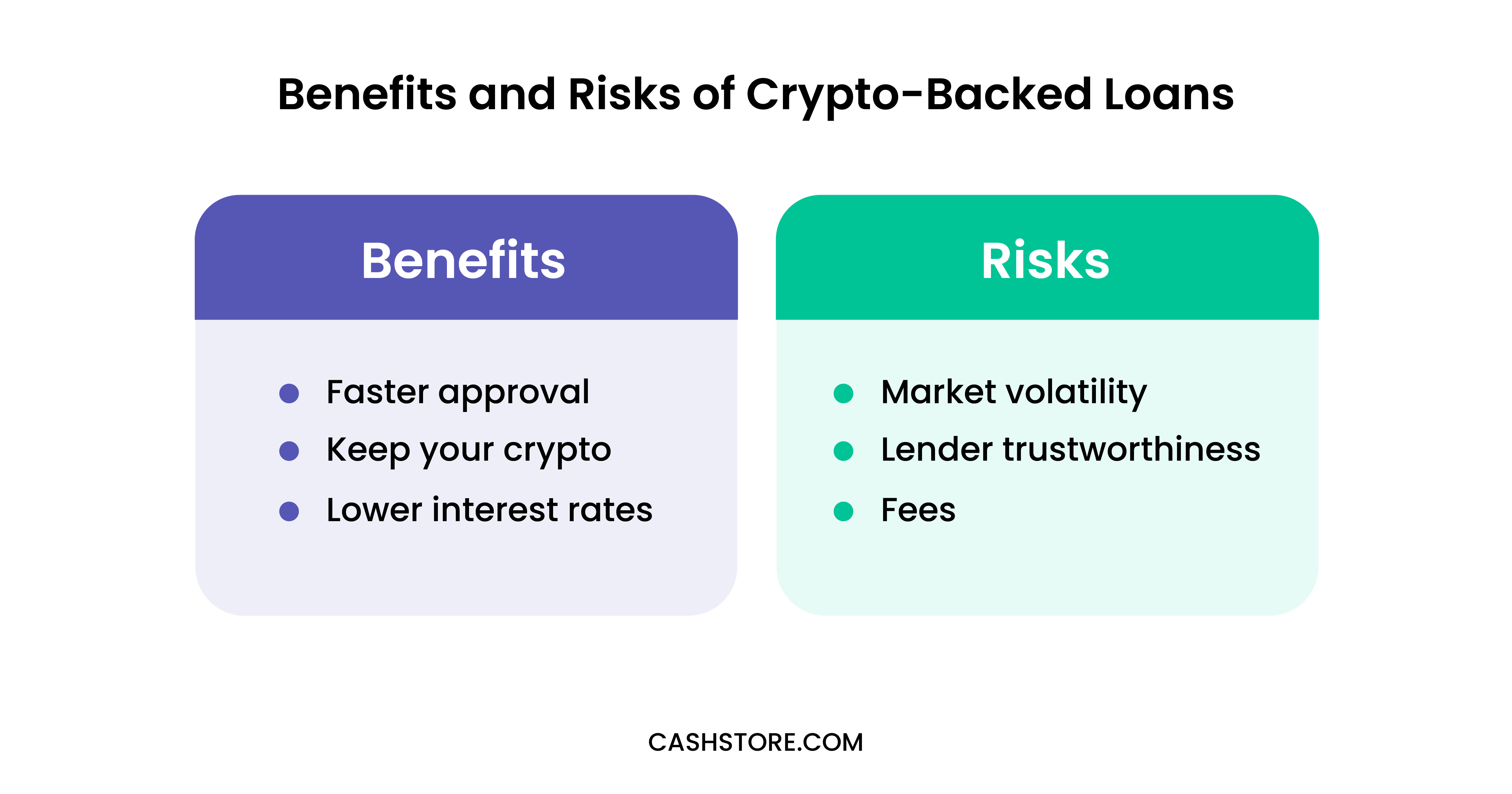

Benefits and Risks of Crypto-Backed Loans

If you’re still thinking a crypto-backed loan sounds like a smart way to get cash without selling your digital assets, you’re not alone. These loans have become popular for good reason—but they’re not without risks.

Benefits

- Faster approval: Many platforms skip traditional credit checks, making the process quicker and more accessible.

- Keep your crypto: You don’t have to sell your assets, which means you still benefit if the market goes up.

- Lower interest rates: Depending on the lender and your collateral, rates may be lower than those of personal loans or credit cards.

Risks

- Market volatility: If your crypto loses value quickly, you could face a margin call—requiring you to add more collateral or risk liquidation.

- Lender trustworthiness: Some platforms may not be regulated, and handing over your assets carries some risk if the company isn’t stable or secure.

- Fees: There may be hidden fees, including withdrawal costs, early repayment penalties, or platform charges.

Who Are These Loans For?

Crypto-backed loans are best suited to people who already have crypto holdings and want cash without giving up their investment. They work well for short-term needs or when you expect crypto prices to rise. However, they may not be the best fit for someone relying on long-term stability or who isn’t familiar with how crypto markets work.

How to Qualify and Apply

Ready to explore a crypto-backed loan? Before jumping in, it’s important to know how to qualify—and how to choose a lender you can feel confident about.

Ready to explore a crypto-backed loan? Before jumping in, it’s important to know how to qualify—and how to choose a lender you can feel confident about.

Choosing a Lender

Look for platforms with a solid reputation, clear terms, and strong security measures. Check for online reviews, how long the platform has been in business, and whether they’ve had any major issues in the past. Make sure you understand the fees, interest rates, and how your crypto is stored while it's being used as collateral.

Setting Loan Terms

Once you pick a lender, you’ll usually choose:

- The amount you want to borrow

- The type of crypto you’ll use as collateral

- Your repayment term (often a few months to a few years)

- Whether you want to receive the loan in cash or stablecoin

The platform will show you your loan-to-value ratio, interest rate, and repayment schedule before you move forward. Some lenders also let you pay early without extra fees.

What Happens if You Default?

If you miss payments—or if the value of your crypto drops too much—your lender may liquidate some or all of your assets to cover the loan. That means you could lose your crypto, even if you were planning to hold it long-term.

Alternatives to Crypto-Backed Loans

While crypto-backed loans can offer quick access to cash without selling your digital assets, they aren’t the only option out there. Depending on your needs and comfort level with crypto, you might want to explore other ways to borrow.

Personal Loans

Offered by banks, credit unions, and online lenders, personal loans are typically unsecured and can be used for just about anything.

- Pros: Fixed payments, no need for collateral, available to non-crypto users

- Cons: Approval may depend on credit score and income

Installment Loans from Cash Store

These short-term loans are designed to help cover urgent expenses with a repayment plan that works for you.

- Pros: No crypto required, flexible terms, fast approval process

- Cons: Interest rates and terms vary based on your location and financial situation

Credit Cards or Lines of Credit

If you already have available credit, this could be a fast way to get access to funds.

- Pros: Easy to use for everyday purchases, no extra loan application

- Cons: High interest rates if balances aren’t paid quickly

Every option comes with trade-offs. Whether you're working with crypto or not, it’s worth comparing the terms, fees, and risks before choosing the best fit for your financial situation.

Is a Crypto-Backed Loan Right for You?

As we have shared, crypto-backed loans offer a way to access cash without selling your digital assets, but they come with their own set of risks and rules. In this guide, we covered how these loans work, who they’re for, and what to consider before applying.

At Cash Store, we share helpful financial insights to support smart borrowing choices. If you’re exploring loan options, check out our blog and consider an installment loan to meet your short-term needs. Complete your prequalification application today.

The content on this page provides general consumer information or tips. It is not financial advice or guidance. Each person’s circumstances are unique. The Cash Store may update this information periodically. This information may also include links or references to third-party resources or content. We do not endorse the third-party or guarantee the accuracy of this third-party information. There may be other resources that also serve your needs.