Cash Store Blog

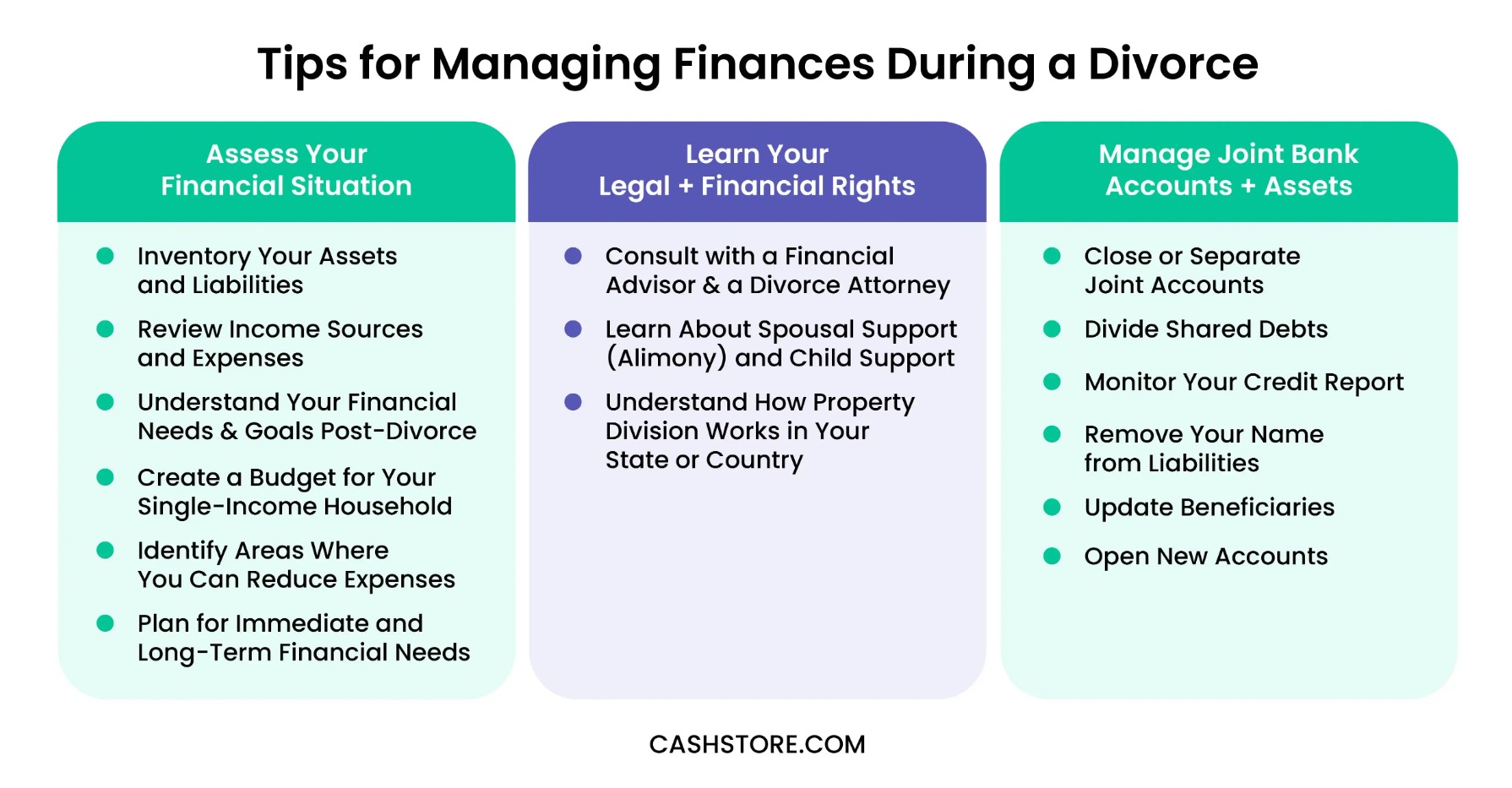

Tips for Managing Finances During a Divorce

Going through a divorce is not for the faint of heart. It’s challenging. Not only is divorce fraught with sadness, anger, disappointment, and maybe even some embarrassment, it leads to a lot of tasks that you never thought you would find yourself facing.

From deciding who will keep the house, who will care for the kids and when, and how to divide your finances, it’s a trying time to say the least. In this article, we’ll share some tips to help you work through your finances and come out better on the other side.

Assess Your Financial Situation and Plan Accordingly

If you follow the Cash Store blog, you know we often discuss the importance of sticking to a family budget. Whether you have followed the 50/20/30 approach that we recommend or you follow a different budgeting strategy, all that work will pay off for you now.

Let's dive into specific steps to take control of your finances during a divorce.

Inventory Your Assets and Liabilities

Start by listing all your assets and liabilities. Assets include things like your home, car, savings, and investments. Liabilities are debts like your mortgage, car loan, and credit card balances. Knowing what you have and what you owe is the first step in making informed financial decisions.

Review Income Sources and Expenses

Next, review all your income sources and expenses. This includes your salary, any child support or alimony, and other income. List your monthly expenses like rent, utilities, groceries, and transportation. This helps you see where your money is coming from and where it's going.

Understand Your Financial Needs and Goals Post-Divorce

Think about what you’ll need financially after the divorce. This could include housing, childcare, and healthcare. Also, consider your financial goals, such as retirement savings or your children’s education.

Create a Detailed Budget for Your New Single-Income Household

With your income and expenses outlined, create a new budget. This budget should reflect your new single-income status. Make sure it covers all your essential expenses and leaves room for savings. This will become your roadmap to financial stability.

Identify Areas Where You Can Reduce Expenses

Look for ways to cut costs. This might mean eating out less, finding a cheaper cell phone plan, or canceling unused subscriptions. Every little bit helps and can add up to significant savings over time.

Plan for Immediate and Long-Term Financial Needs

Finally, plan for both immediate and long-term needs. In the short term, you should set aside money for moving expenses or legal fees. Long-term, think about building an emergency fund, saving for retirement, and investing in your future. This plan will give you some peace of mind as you work through this challenging time.

Learn Your Legal + Financial Rights

While navigating a divorce without legal representation or financial advisory is possible, this is often easiest when things are being split down the middle, and there is nothing to contest. However, when you have disparate incomes and children in the mix, hiring a divorce attorney can help you work through the situation.

Here are some things you may wish to consider when managing finances during divorce.

Consult with a Financial Advisor and a Divorce Attorney

Consulting with both a financial advisor and a divorce attorney can provide you with the expert guidance you need. A financial advisor can help you understand your financial situation and plan for the future. At the same time, a divorce attorney can protect your legal rights and help negotiate fair terms.

Learn About Spousal Support (Alimony) and Child Support

Understanding spousal support (alimony) and child support is super important during a divorce. Spousal support is financial assistance paid to a lower-earning spouse, while child support covers the costs of raising children. Knowing how these work can help you budget and plan for your new financial reality.

Understand How Property Division Works in Your State or Country

Property division laws vary by state and country, so it's important to understand how these laws apply to your situation. Some places follow community property rules, splitting assets 50/50, while others use equitable distribution, which divides assets based on fairness.

Manage Joint Bank Accounts + Assets

Divorce often requires untangling joint financial accounts and assets to help both parties move forward independently. Here are some steps to help you effectively manage joint bank accounts and assets during a divorce.

Close or Separate Joint Accounts

Close or separate joint bank accounts and credit cards to protect your finances. This makes both parties financially independent and prevents one spouse from withdrawing all the funds or accruing debt. Communicate with your ex-spouse and the financial institutions to complete this process without any hiccups.

Divide Shared Debts

Divide shared debts and pay them off or transfer them to individual accounts. Work with your ex-spouse and creditors to allocate responsibility for debts like mortgages, car loans, and credit cards. This step is super important to avoid future credit issues.

Monitor Your Credit Report

Monitor your credit report for any discrepancies or joint accounts that need addressing. And, regularly checking your credit score helps identify any issues arising from joint accounts or debts. If you see any issues, be sure to take prompt action by reaching out to the creditor for resolution

Update Beneficiaries

Update beneficiaries on insurance policies, retirement accounts, and wills. Review and change the beneficiaries to reflect your new circumstances. This step directs your assets and benefits to the intended recipients and avoids potential legal complications in the future.

Open New Accounts

Consider opening new accounts solely in your name. Establishing individual bank accounts and credit cards helps you rebuild your financial independence and credit history. Be sure these new accounts manage all future income and expenses.

To get started, complete our prequalification application today.