Cash Store Blog

Managing Gig Worker Earnings: 5 Tips

The gig economy has taken the U.S. by storm in recent years. Data suggests that about 54% of Americans have taken on some side hustle in the last 12 months. And if you’re one of them, you know that managing the income fluctuations that accompany a gig can be tricky. After all, unlike traditional employers who take out taxes from your paycheck and pay them to the appropriate governments on your behalf, you need to manage that on your own when working a side hustle.

For this reason, meticulous financial management is super important. Without a close eye on your income and tax requirements, you can quickly find yourself in a financial pickle. In this article, we’ll share five tips to help you manage your gig work earnings.

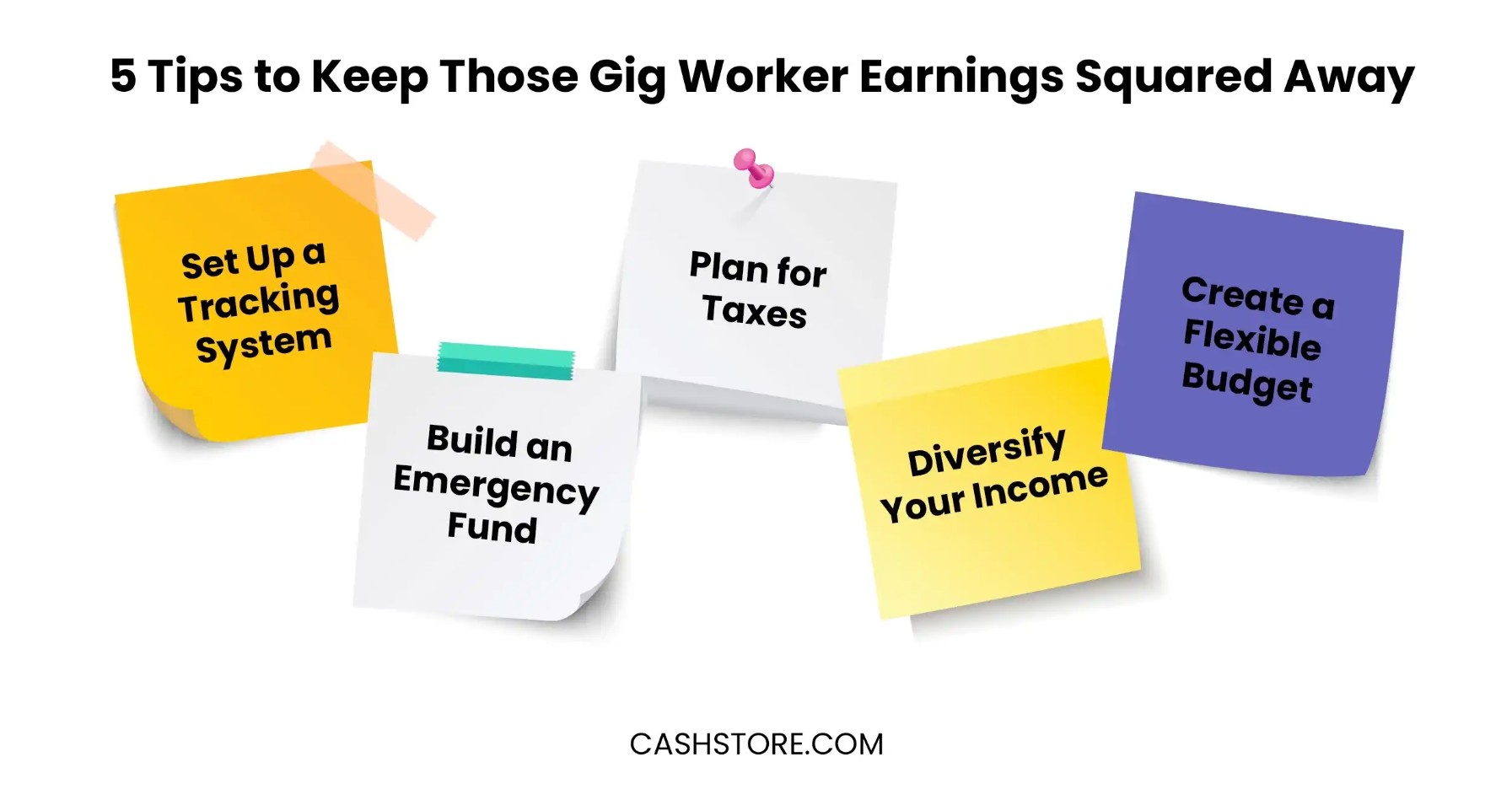

5 Tips to Keep Those Gig Worker Earnings Squared Away

Taking on a side hustle is a great way to grow your income, whether it is a short-term gig or something you wish to pursue long-term. But, as we suggested above, you need to manage your income a bit differently than you might do with more traditional employment and a steady paycheck.

So, without further ado, let’s get into five tips from the Cash Store team on how to keep your gig worker earnings organized and to prevent unexpected tax implications down the road.

1. Set Up a Tracking System for Gig Worker Income and Expenses

As a gig worker, a good organizational system will be your best friend. Here are some tups to help you be as successful as possible.

- Use Financial Tracking Tools: Apps like QuickBooks Self-Employed or Mint, or even a simple spreadsheet, can help you keep a clear record of your earnings and expenses, making tax time easier. However, as you grow, you may appreciate a more formalized process vs. using those manual spreadsheets available on your laptop.

- Separate Business and Personal Accounts: Open separate accounts for your gig work to keep your personal and business finances distinct. This makes it simpler to track income and expenses.

- Review Monthly: Set aside time each month to review your financials. Regular reviews will help you understand your cash flow and make sure you're on track with your financial goals.

2. Build an Emergency Fund

When working a side hustle, you must remember that your income will very likely fluctuate from week to week. Some weeks you may have more work than you know what to do with, and other weeks may be unexpectedly quiet. This is why an emergency fund is so important. If you have a slow week, you want that reassurance that you’ll be able to make ends meet until things pick up again.

Here are a few quick tips to get you started.

- Start Small and Grow Over Time: Begin by setting aside a portion of each payment, even if it's just a small amount. Over time, aim to build up enough to cover three to six months of living expenses.

- Automate Savings: Set up automatic transfers or use a percentage-based system to make saving consistent and easy. This way, you won't have to think about it each time you receive a payment.

- Consider a High-Yield Savings Account: Open a high-yield savings account to help your emergency fund grow faster with interest, maximizing the benefits of the money you save.

3. Plan for Taxes

When you’re working a gig, you need to take responsibility for your tax obligations to the government. So, it’s important to remember that whenever you get paid, you need to set a portion of that money aside to pay in for taxes. And if you are working in the gig economy full-time without supplemental income from more traditional employment, you may also want to set aside money for your retirement.

Here are some tips to help you be successful.

- Set Aside a Percentage of Each Payment: It’s a good idea to reserve about 25-30% of each payment you receive for federal, state, and local taxes. This way, you're prepared when it's time to pay taxes.

- Pay Quarterly Estimated Taxes: If you're a full-time gig worker, quarterly estimated payments are required. Estimate these payments based on your earnings to avoid penalties and keep up with your tax obligations.

- Track Deductible Expenses: Keep a record of common deductible expenses, such as vehicle mileage, home office costs, and software fees. These deductions can lower your taxable income and save you money at tax time.

4. Diversify Your Income

While the gig economy can be quite lucrative, it can be unpredictable. As such, we recommend that you diversify your income. Here’s what to consider.

- Why Diversification Matters: Having multiple sources of income can help balance out the ups and downs of gig work, reducing the risk of financial strain during slow periods.

- Explore Complementary Gigs: Look for additional jobs that complement your current work, such as freelance writing, tutoring, or virtual assistant roles. These options can fill in gaps when your primary gig is slow.

- Invest in Skills Development: Consider taking online courses or earning certifications to broaden your skills and open up new income opportunities in different fields.

5. Create a Flexible Budget

Last but certainly not least, make sure you have a good budgeting system in place. We often suggest the use of the 50/20/30 methodology that can help make sure you aren’t spending more than you should on your wants. Rather, your money gets focused on your needs so you don’t fall short from month to month.

Here are a few other points to help you be successful with your budget.

- Use the "Pay Yourself First" Method: Prioritize setting aside money for savings and covering essential expenses before you spend on non-essential items. This helps you build a solid financial foundation.

- Establish a Baseline Budget: Create a basic budget that covers only your essential expenses. This can be especially useful during slower months when your income fluctuates.

- Plan for Surplus Months: When you experience higher-earning months, allocate extra funds towards paying off debt, increasing savings, or investing in future opportunities. This way, you're prepared for any financial uncertainties ahead.