Cash Store Blog

Do “Instant Loans” Actually Exist?

Emergencies happen—that’s why they’re called emergencies. They’re those things we can’t necessarily prepare for, like a clogged toilet that has caused a backup in the septic system at our home, a broken-down transmission keeping our car from getting us from point A to point B, or that excruciating toothache that means you need a dental crown, and your dental insurance won’t cover the entire procedure.

When these things happen, you can’t put off the solution. Will you wear a nose plug and run over to the neighbors whenever you need to use the bathroom? Are you going to walk to work? Are you going to deal with the tooth pain? The answer to all these questions is no. The truth is when these emergencies arise, you need to take action. And, you need the funds fast to do the job—pun intended.

In this article, we’ll give you the down-low on instant loans and how they can help you in an emergency. We’ll also explain what the term instant loans really means so that you can manage your expectations and not set yourself up for disappointment.

Let’s get started.

What Types of Loans are Often Marketed as Instant Loans?

A recent article released by Bankrate suggests that 27% of Americans don’t have an emergency fund. We also know that even more Americans out there are living paycheck to paycheck, which means they don’t have funds on hand when these emergencies creep up.

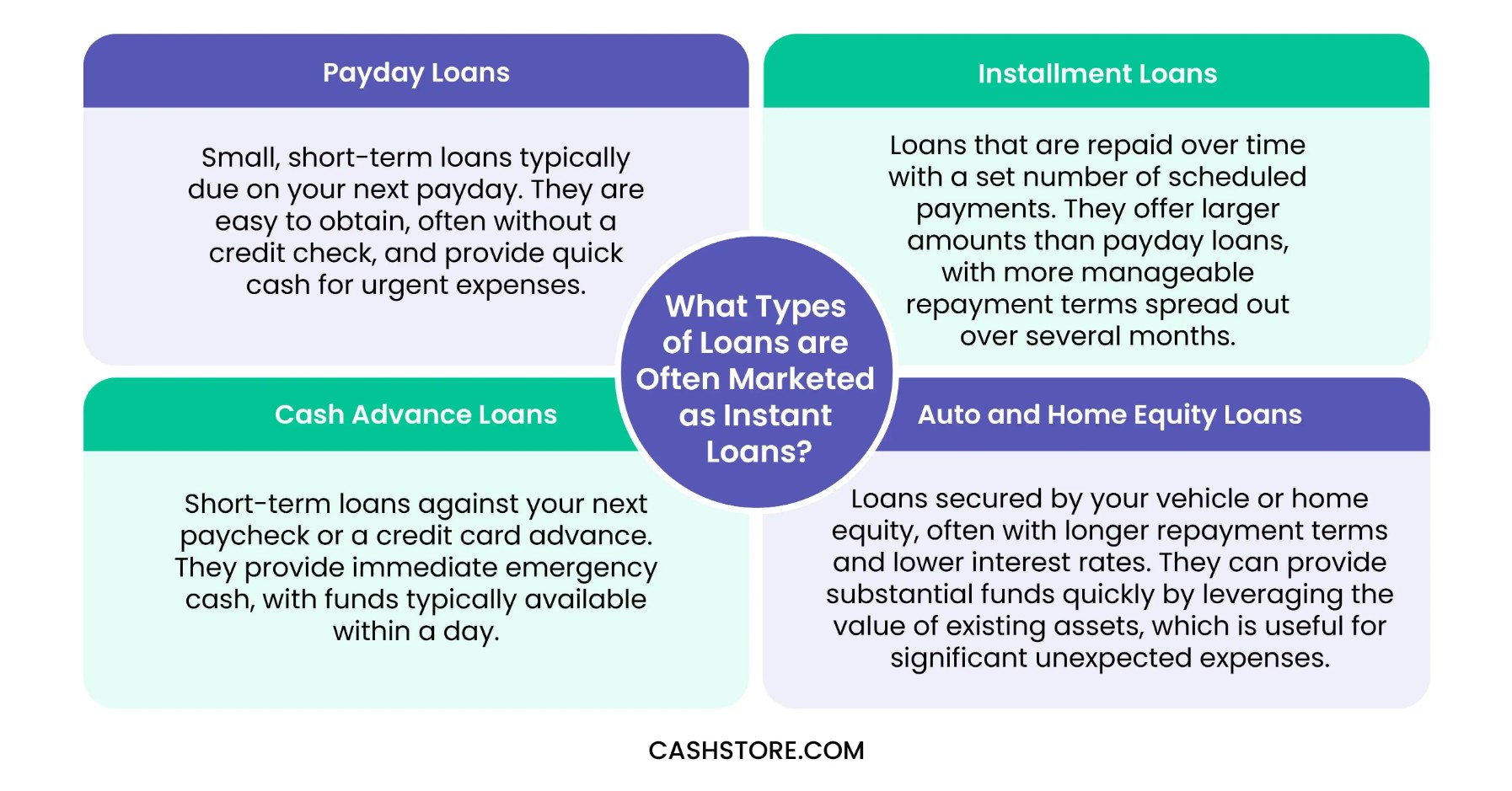

That’s where instant loans can come to the rescue. So, let’s look at the four primary types of loans that are often referred to as instant loans.

- Payday Loans: Small, short-term loans typically due on your next payday. They are easy to obtain, often without a credit check, and provide quick cash for urgent expenses.

- Installment Loans: Loans that are repaid over time with a set number of scheduled payments. They offer larger amounts than payday loans, with more manageable repayment terms spread out over several months.

- Cash Loans: Short-term loans against your next paycheck or a credit card advance. They provide immediate emergency cash, with funds typically available within a day.

- Auto and Home Equity Loans: Loans secured by your vehicle or home equity, often with longer repayment terms and lower interest rates. They can provide substantial funds quickly by leveraging the value of existing assets, which is useful for significant unexpected expenses.

Why “Instant Loans” Aren’t Exactly Funded Instantly

Here is where things can get a bit tricky. The idea of an instant loan is a bit of a misnomer, as these loans aren’t funded instantly. There is always going to be some sort of delay, whether it is a few hours to a few days and sometimes even to a few weeks. That said, when financial institutions advertise an instant loan, they are usually referring to a loan that will get you your funds in one to two days or less. So, it's important to read the fine print and know what you are applying for and when you might receive your money.

Let’s look at the steps that lenders take to help award you your loan funds.

Application

At Cash Store, you’ll need to provide personal information such as your name, address, and Social Security number, employment details, income information, and bank account details. This helps verify your identity and financial stability. This process is relatively consistent across all lenders.

Approval Process

This can vary by lender and loan type. Some lenders can approve within minutes, while others may take several days. Longer approval times might occur if additional documentation is required or if the borrower has a complicated credit history.

Distribution Method

This will also vary based on the lender. Here are the typical options.

- ACH (Automated Clearing House): Funds are transferred directly to your bank account, typically within one business day.

- Debit Cards: Some lenders offer the option to load funds onto a prepaid debit card for immediate use.

- Traditional Checks via Mail: Although less common, some lenders might send a check by mail, which can take several days to arrive.

Cash Store’s Cash Loans Let You Pick Up Your Cash on the Same Day

If you are in need of emergency funds, make sure you do your homework before applying and signing on the dotted line with any lender. We know that in these situations, it can feel desperate, and you want to make a quick decision. But doing so can sometimes create a bigger problem than what you are dealing with in the first place. Taking a few moments to slow down and read the offer, terms, and conditions will pay it forward. Trust us.

That said, if you are in need of same day cash, Cash Store can help. Our cash loans let you pick up your cash on the same day so you can get on your way. Complete our prequalification application to get started.