Cash Store Blog

Best Finance Apps for Couples in 2024

Did you know that financial stress is one of the leading causes of divorce in the U.S.? While exact statistics are hard to come by, some legal experts suggest that 20 to 40% of divorces are due to just that—money troubles.

So, whether you are just entering a relationship or you have a long-time partner, it is worthwhile to discuss your approach to budgeting, retirement planning, and saving for emergencies. But, we know that this might be easier said than done. That’s why we’re going to share some of our favorite finance apps for couples. Not only can these apps help make the conversation a bit easier, they can also help you when applying for loans.

Top 5 Finance Apps for Couples to Know in 2024

We certainly are a technology-savvy population. Insights from the Pew Research Center suggest that 97% of reasonably-aged Americans have a smartphone. And more so, smartphone users spend over four hours a day interacting with apps. As such, it only makes sense that couples turn to apps to help with their financial management.

Here are the apps you and your partner should know about.

Best App for Basic Everyday Budgeting

EveryDollar is designed to simplify budget creation and tracking. This intuitive app, part of the Ramsey Solutions suite, guides couples through setting up a customized monthly budget that can be shared and synchronized between devices.

With EveryDollar, users can quickly allocate every dollar of income towards expenses, savings, and debts, ensuring financial goals are transparent and collaborative. The app emphasizes zero-based budgeting, which can be particularly effective for couples looking to optimize their financial planning.

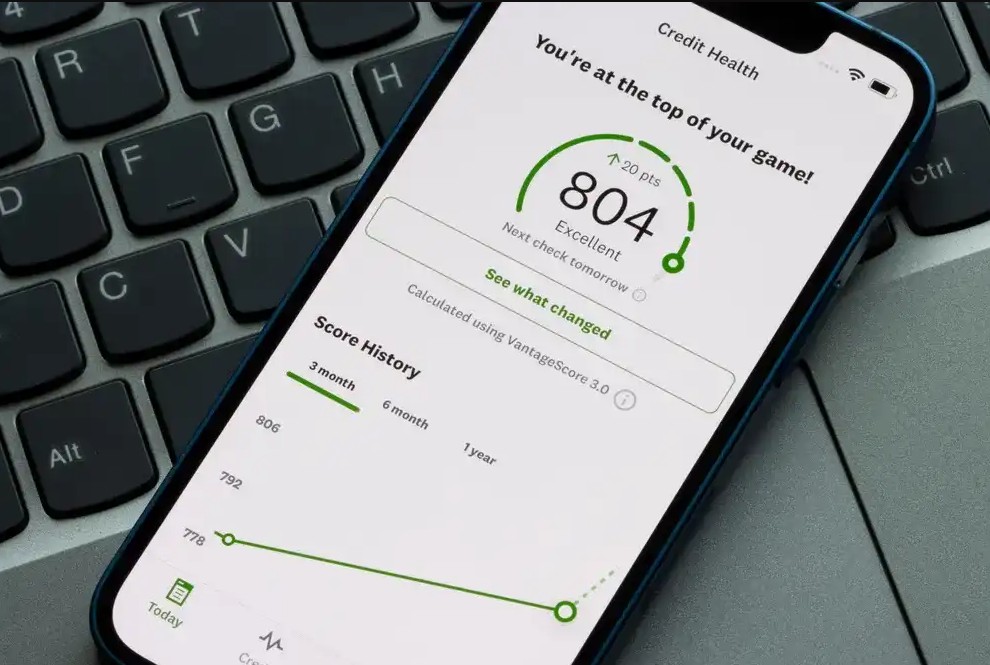

Best App for Maintaining Good Credit and Financial Health

Unfortunately, many people don’t understand the importance of a healthy credit score. And, a low score can harm your ability to get access to great financial products at low-interest rates and with flexible terms. Thankfully, apps like Credit Karma (formerly Mint) are designed to help you change your approach to financial management and boost your credit score over time. Signing up will give you access to your credit score and will provide you with some hacks to help you every step of the way.

Best App for Managing Expenses and Bills

PocketGuard is our suggested top choice for managing expenses and bills, including tracking loan payments. This app simplifies financial oversight by categorizing all spending and showing users how much money they have "in their pocket" for day-to-day expenses after accounting for scheduled bills, savings contributions, and debts. Its feature to track loan payments ensures couples can seamlessly stay on top of their financial obligations.

Best App for Investments

According to the 50/20/30 budgeting rule, you should try to allocate 20% of your income to savings, retirement, and related investments. But doing this isn’t always easy. Apps like Robinhood make it more accessible. This app offers an easy-to-use platform to buy and sell stocks, ETFs, and cryptocurrencies without commission fees. This investment app for couples has a user-friendly interface and real-time market data that encourages regular investment.

Best App for Couples, Exclusively

Lastly, we want to introduce you to the Honeydue app, a premier budgeting app for couples. Honeydue specializes in collaborative financial management, allowing partners to view each other's balances and transactions while managing bills together. Its features support customizable budget tracking, spending alerts, and easy communication within the app, making it an indispensable tool for couples dedicated to achieving their financial goals together.

Looking for More Great Tools for Couples to Improve Financial Literacy?

Despite our very best efforts, sometimes our money management doesn’t go as smoothly as we want it to. That’s why the finance apps for couples that we shared above can be so useful. But, those aren’t the only tools to help you make smarter money moves or grow your financial literacy.

Check out our recommendations on the best coupon apps, cashback grocery apps, and personal finance apps (if those relationships go south). Leveraging technology, listening to podcasts, and even taking free courses, can help you take control of your finances.

Be sure to follow the Cash Store blog for more great financial insights.